Value.Chains

Understand Impact & Potential Before You Invest

Investment Smartly. Invest Quickly. Whether an investment is aimed at introducing new technology, promoting resilience, driving social change or scaling a commercial enterprise, Emerging market investments require focus on each market segment, respect for the status quo, and a collaborative mindset.

Click below to learn how BonRezo helps design tailored value chain stories to optimize emerging market investments.

How Does the Value Chain Flow?

We start by understanding how goods and services (assets) flow from producer to consumer in the value chain.

- How many steps?

- How many actors and agents?

- What is the production and processing capacity?

- What inputs are used?

- How are they supplied?

- How are transactions made?

- How is the asset transported through the chain?

- Who are the consumers and how do they acquire the asset?

Most importantly, how will the investment change the status quo?

How will Chain Links be Impacted?

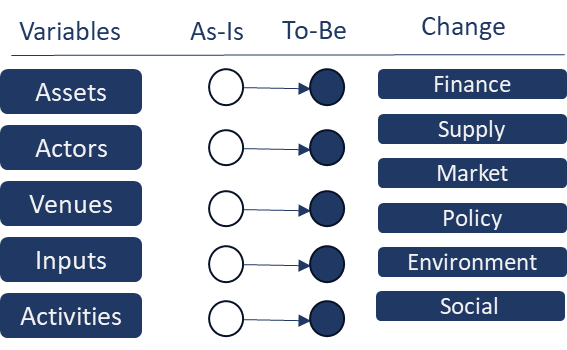

We evaluate how critical parts of the value chain will be impacted by an investment.

Key questions include:

- Does the asset change? A new variety? Higher quality or quantity?

- Do actors keep their same roles or change them? Are new actors introduced?

- What is the production environment? The climate, geography, natural resources?

- Will inputs change? What is the cost? What is the supply chain?

- Do core activities change? New Methods? More or less time?

Additional high-impact considerations include:

- What are the changes in costs, revenue and duration of activities for each actor?

- Does the current supply chain support the changes? The new inputs?

- Is there an existing market for the new asset?

- Are there any policy considerations?

- What is the impact on the environment and climate?

- What is the social impact? on Gender? on Youth?

- Will producers and consumers realize the value shift?

How are Costs and Value Exchanged?

Each change in asset ownership includes the costs plus the value added by the seller. We look at how those costs and values are aggregated and disbursed through the chain. Any cost or value - financial, social, environmental or other - can be tracked.

Value exchanges offer important insight into investment impact and sustainability.

- What is the total cost of the asset to that point? Financial, Environmental, Social?

- What are the limits and constraints on both parties to complete the exchange?

- What are the physical, legal and capacity constraints on the exchange?

- What is the value gained by the seller?

- What is the potential value for the buyer?

- What are the total value shifts caused by the investment?

- Are consumers willing to consume additional costs or pay a premium for the improved assets?

How do Market Influences Flow?

The benefit of investing with a value change lens is the ability to clearly define markets. We evaluate markets at three levels:

The Exchange Market looks at the immediate options available to the supply and demand side in a transaction. This helps clarify buyer and seller negotiating leverage.

The Demand Market looks at the options available to a buyer after acquisition. This helps clarify the diversity of the market. Who can they sell it to? Can the asset take multiple paths to the consumer? What are the options for processing or byproduct channels?

Finally, the Value Chain Market looks at the full system from production to consumption. This helps clarify the connection and impact between producers and consumers. What is the physical distance between consumers and producers? How long an asset can be stored in a value chain before being consumed? How complex are logistics and dependencies? What is the potential for value chain diversification?

What are the Potential Investment Outcomes?

After a value chain is analyzed, we can make some qualified assumptions about potential impacts and gaps to fill.

We compare the current and projected value chains by looking at high-impact changes including:

- Production volume and quality added to the market

- Input and supply capacity changes

- Processing capacity changes

- Logistics and equipment demand

- Environment and water impact

- Social and livelihood changes

- Financial changes for each actor

- Cash flow impact for each actor

- Cash flow capacity for each actor

- Legal and policy barriers

So...How can an investment sustain and scale?

A value chain assessment results in an investment model that can stand on its own or become a key input into a comprehensive Go-To-Market plan.

The investment model highlights investment priorities for sustainability and scale:

- Capital required for the investment

- Key areas for market development

- Inputs and supply chain enhancements

- Cash flow and finance needed for each actor in the chain

- Risk areas and need for instruments like insurance and program structures

- Change management considerations for value chain actors and communities

- Additional logistics, storage and equipment demand

- Policy and legal barriers to address